We're building the best investment platform for entrepreneurs

Invest in Crowd2Fund and share in our success, already 30% funded.

Invest in Crowd2Fund and share in our success, already 30% funded.

Finance needs to be fast, fair and flexible to meet today's demands.

Due to regulatory restrictions post-2008, banks aren't able to lend as much, and non-secured lending is even more difficult. However, the need for financing still remains. Therefore, the market is ripe for disruption, with £2bn transactions per year in UK peer-to-business lending.

Crowd2Fund is an online platform for private businesses and investors, offering carefully selected opportunities. Businesses get access to funds at competitive rates, and investors get generous returns on their investments, tax free, through the Innovative Finance ISA.

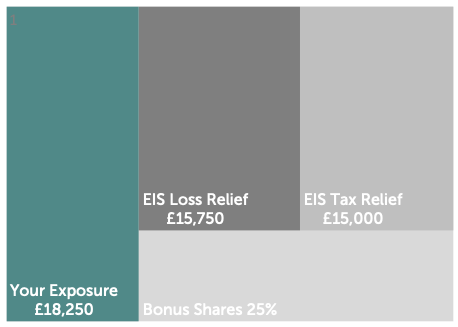

Crowd2Fund has recently become approved for the generous government Enterprise Investment Scheme. This means that up to £12m can be invested through this scheme from investors who can potentially receive generous tax relief.

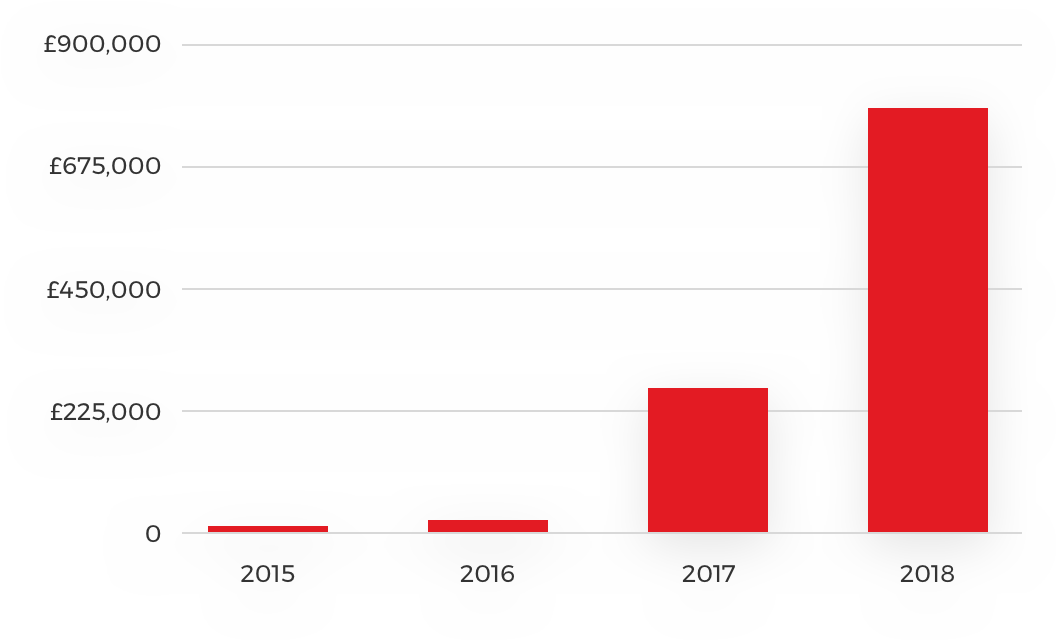

We've experienced exponential revenue growth for the past 3 years and facilitated more than £33m in investment. We want to continue this growth.

The UK FinTech market is one of the fastest growing markets in the world. In 2018, Crowd2Fund achieved £832k in revenue with relatively steady costs.

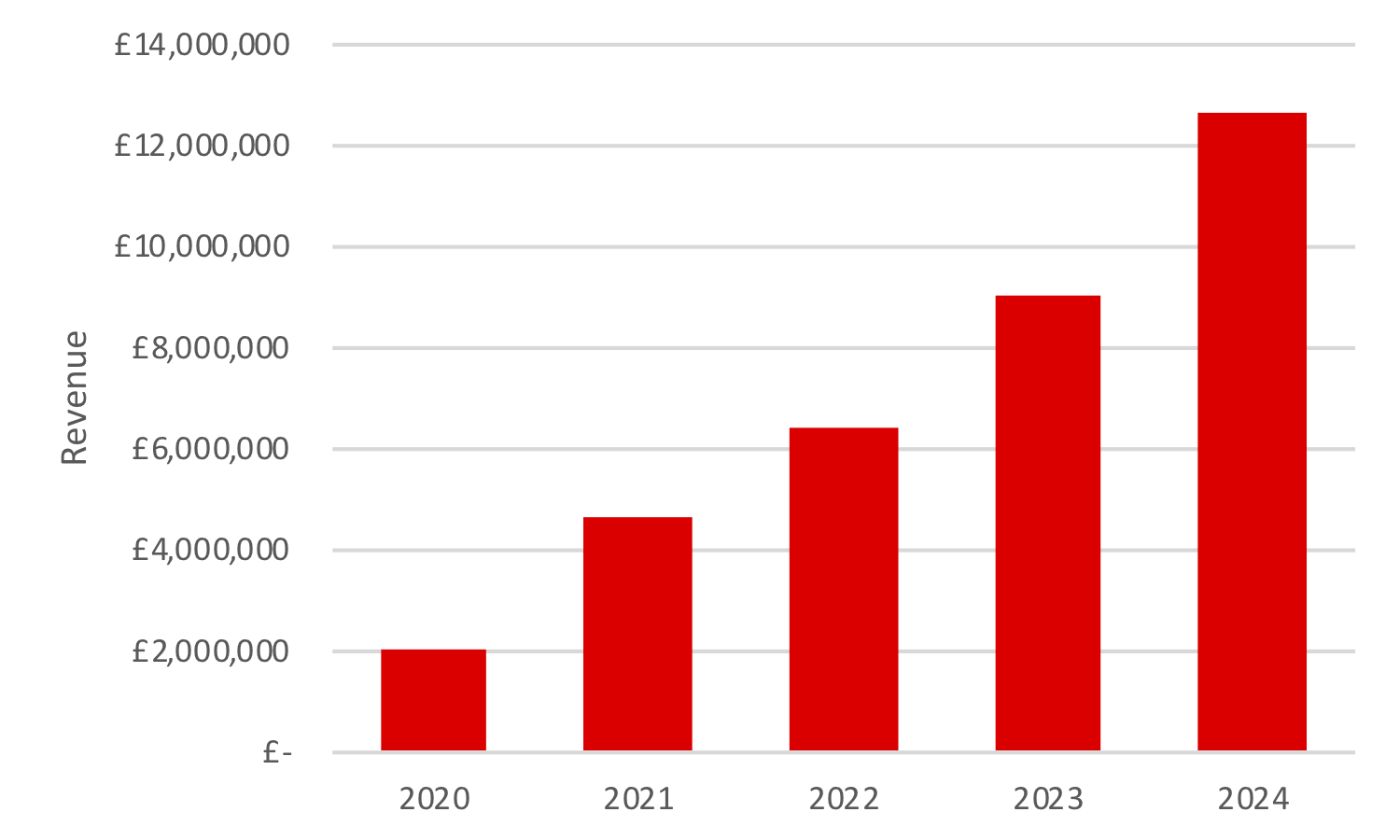

Next year we can deliver £34m in lending generating £2m in revenue after securing a £10m Series A investment round.

After a Series A investment round which we aim to secure next year we can build the business to be lending £210m per year and generating £12.6m in revenue thus valuing the business at £353m. We want to go further though and raise more investment rounds to seize the market opportunity.

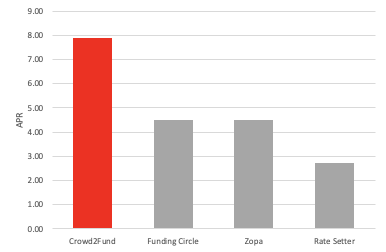

Our returns are highly competitive. This is how Crowd2Fund compares with other platforms in the peer-to-business lending space. Crucially though, because we allow investors to choose the investments you can earn up to 15% by making good investments.

They earn an estimated 10.46% APR before fees and bad debt tax-free via the IFISA

Crowd2Fund is the first platform of its kind to be directly regulated. We work with the FCA to build trust and robust processes, thereby delivering a better service for our clients.

Businesses who need funding submit a business proposal to Crowd2Fund.

Our Risk and Due Diligence team reviews the proposal against our strict acceptance criteria.

Successful businesses are listed; investors pledge the amount they want to invest.

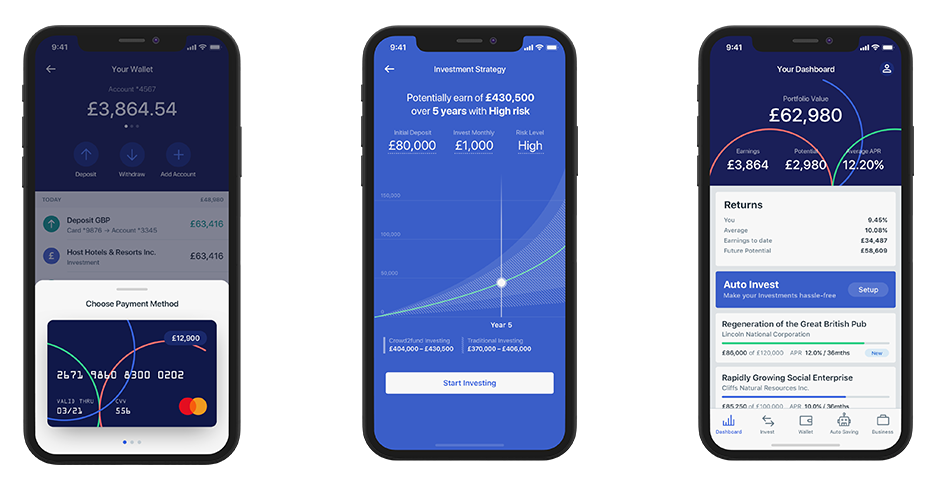

Crowd2Fund is built by some of the world's best designers and engineers, leveraging innovation to challenge incumbent platforms.

We're a lean team, building impeccable user experiences with state of the art technology.

Fully mobile responsive, working seamlessly on all handsets also with an iOS App.

A comprehensive API allows integration of other third-party clients and additional compliance services.

We maximise the speed of business approval and minimise operational costs with our auto risk assessment tool.

For our time-poor investors, our Smart-Invest feature uses AI and big data analysis to invest on investor's behalf.

We're becoming Blockchain enabled which offers investors a better and more secure experience whilst future proofing the platform.

Our business model is now proven based on years of reliable data and we are ready to scale. We plan to grow the business to at least a value of £353m over the next few years offering a potential 10x return on investment.

Next year we plan to proceed to a Series A £10m institutional raise. As our business model is proven, with this investment we aim to grow the business to a value of £353m and deliver the worlds first decentralised bank, offering full banking services including deposits, bank accounts and card payments for entrepreneurs.

By investing you become part of our investor club where we hold regular events and you also get access to exclusive offers.

Led by experienced digital finance, investment, and marketing people, Crowd2Fund is a committed team of 12 employees in London and Bucharest.

We are raising £1.2m from private investors via the generous EIS tax scheme which will allow us to grow the business to £99m.

For the first time, the opportunity is offered to non-Crowd2Fund users. All eligible shares will be transferable on the Exchange in the future as the business grows.

Learn moreWe however plan a further raise of £10m which will allow us to grow the business to £353m by 2024 giving you a potential 10x return on your investment, assuming no dilution.

Learn more

Crowd2Fund is one of 10 companies selected by the Department for International Trade to be on a highly prestigious international FinTech programme which is to facilitate cross border trade in the FinTech sector between Australia and the United Kingdom. At this time we are actively setting up in Australia.

More information

Crowd2Fund is a keen supporter of the GFIN. A new global trade hub specifically for FinTech focused on facilitating cross jurisdiction FinTech transactions. We plan to expand internationally across this network and are keenly watching for the alignment of regulations which will make it much easier to penetrate international markets.

We provide access to a community of engaged investors who act as brand advocates, driving sales across local and global markets.

We’ve already seen a lot of interest and pledges in the round with 30% funded of £1,200,000 from 32 investors. Apart from receiving the EIS relief an investment will mean you don’t pay fees for life and you’ll receive other great perks. We would be delighted if you wanted to join us on the Crowd2Fund journey.

Past performance and forecasts are not reliable indicators of future results. Tax treatment of any of the investment offers will depend on the individual circumstances of each investor and may be subject to change in the future. Remember, your actual return may be higher or lower as your capital is at risk.